The Ongoing Debate Over Maine's Income Tax Elimination Proposal

The contentious proposal to eliminate income tax in Maine has sparked significant discussion among residents, businesses, and lawmakers. The bill, which aims to phase out income tax over a five-year period starting in 2024, is currently facing staunch opposition from Democrats who control both the House and Senate in Maine's State House. Despite the uncertain future of the bill, its proponents argue that the bold move could lead to substantial financial benefits for Mainers, as well as businesses operating in the state.

Representative David Boyer of Poland has proposed the bill, which is designed to gradually reduce the state's tax each year. This approach allows each state department to make necessary adjustments to their annual budgets, providing ample time to identify wasteful spending and implement required cuts. Boyer contends that despite a 20% increase in the state's budget since the last budget, there has not been a corresponding improvement in services such as roads and other infrastructure projects.

However, opponents of the bill express concerns that the elimination of income tax would leave the state with insufficient funding to fulfill its responsibilities. This sentiment is echoed by House Speaker Mark Eves, a Democrat, who has stated that Maine's tax system is broken and disproportionately benefits those at the very top. Eves believes that the current proposal would only exacerbate the issue.

The concept of eliminating income tax in Maine is not new. In 2015, then-Governor Paul LePage proposed an amendment to the state's constitution to permanently prohibit the Legislature from imposing income tax on any person, starting in 2020. To compensate for lost revenues, LePage's two-year budget plan aimed to increase sales taxes, cut off state revenue sharing with local municipalities, and impose taxes on certain non-profit organizations.

LePage's proposal, however, met with fierce resistance from Democrats, who rejected the idea outright. In response, they offered a counter-proposal that called for a decrease, rather than elimination, of income tax, alongside lowered property taxes and an unchanged sales tax.

If the current bill is enacted and income from residents tax is abolished in Maine, the state would join the ranks of 10 other states that have either partially or completely eliminated their income tax. At present, seven states have no income tax, while New Hampshire and Tennessee tax only dividend and investment income.

Boyer concedes that the bill's passage in its current form is unlikely. Nevertheless, he remains dedicated to advocating for tax breaks wherever possible, in the hope of alleviating the financial burden on Maine's large retiree population, who live on fixed incomes, as well as benefiting higher-income "job creators."

The bill is anticipated to reach the House floor within the next 4-6 weeks, where its fate will be determined. In the meantime, the ongoing debate over the elimination of income tax in Maine continues to generate strong opinions from both supporters and detractors. Whether the bill ultimately succeeds or fails, the conversation surrounding Maine's tax system and potential reforms is not expected to dissipate anytime soon.

As Maine grapples with the prospect of income tax elimination, residents, businesses, and lawmakers must weigh the potential benefits against the concerns raised by its opponents. The outcome of this debate will have lasting implications for the state's financial landscape and may influence similar discussions in other states across the country. Regardless of the bill's eventual fate, the conversation it has sparked about Maine's tax system and the need for potential reforms highlights the importance of engaging in informed, balanced discussions around such critical issues.

Contact Propono for help with the IRS and the Maine Tax Authority.

IRS Unveils Detailed Strategy for Allocating $80 Billion in Additional Resources

In an extensive report submitted to the Secretary of the Treasury, the Internal Revenue Service (IRS) has presented its strategic operating plan for the upcoming decade. This plan details how the agency intends to utilize the extra $80 billion in funding it recently received to improve customer service, expand its ability to scrutinize large corporations and high-income individual taxpayers, and upgrade its obsolete systems and technology infrastructure.

Newly appointed IRS Commissioner Danny Werfel has expressed that the plan foresees a promising future for both taxpayers and the IRS. The agency will undergo a significant transformation in its operations, delivering the services that taxpayers are entitled to. Werfel also highlighted that the future IRS experience will be distinctly different from its current state, driven by substantial advancements in service and technology.

The IRS has developed the 150-page Strategic Operating Plan in response to the Inflation Reduction Act passed in August of the previous year, which allocated $80 billion in new funding to the agency over a ten-year period. The plan aims to address concerns about the use of these funds, as the initial announcement of the additional resources raised concerns that the IRS might target middle-class taxpayers and small businesses. This led Republicans in Congress to propose the withdrawal of the funding.

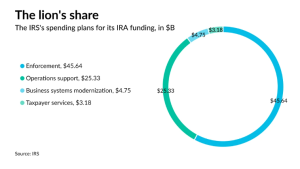

The IRS has specified that the $80 billion will be distributed across three primary areas:

- To "rebuild and strengthen" customer service operations, which experienced significant setbacks during the pandemic, resulting in infamously long wait times on IRS phone lines;

- To augment the agency's ability to audit high-income taxpayers (roughly 30,000 individuals earning more than $10 million per year) and intricate large businesses; and,

- To modernize the agency's numerous outdated technology systems.

The strategic plan includes 42 "key initiatives" and 190 "key projects" that the IRS will carry out over the next decade, with the option to introduce additional projects as required.

While the plan refers to the hiring of nearly 30,000 new employees, including 5,000 customer service representatives, it does not specify how many of these new hires will be assigned to enforcement roles. However, given that $45 billion of the total $80 billion is designated for enforcement, it is probable that a considerable number of new employees will be allocated to this area.

A significant portion of the new hires will offset ongoing attrition and the long-term reduction in funding and staffing levels. The IRS currently has around 80,000 employees, approximately 19% fewer than the 95,000 it had in 2010.

Werfel stressed that the agency has been unable to provide the level of service taxpayers deserve for several years. He stated that the IRS is enthusiastic about showcasing how the actions outlined in the plan will lead to concrete improvements for taxpayers, with technology and in-person assistance forming essential elements of this endeavor.

The commissioner asserted that the influence of the additional funding is already evident, as the first signs of change can be observed during this tax filing season. He referred to the substantial improvement in phone service due to increased staffing, the expansion of walk-in services nationwide, and the implementation of new digital tools as initial steps in this transformative process.