IRS Unveils Detailed Strategy for Allocating $80 Billion in Additional Resources

In an extensive report submitted to the Secretary of the Treasury, the Internal Revenue Service (IRS) has presented its strategic operating plan for the upcoming decade. This plan details how the agency intends to utilize the extra $80 billion in funding it recently received to improve customer service, expand its ability to scrutinize large corporations and high-income individual taxpayers, and upgrade its obsolete systems and technology infrastructure.

Newly appointed IRS Commissioner Danny Werfel has expressed that the plan foresees a promising future for both taxpayers and the IRS. The agency will undergo a significant transformation in its operations, delivering the services that taxpayers are entitled to. Werfel also highlighted that the future IRS experience will be distinctly different from its current state, driven by substantial advancements in service and technology.

The IRS has developed the 150-page Strategic Operating Plan in response to the Inflation Reduction Act passed in August of the previous year, which allocated $80 billion in new funding to the agency over a ten-year period. The plan aims to address concerns about the use of these funds, as the initial announcement of the additional resources raised concerns that the IRS might target middle-class taxpayers and small businesses. This led Republicans in Congress to propose the withdrawal of the funding.

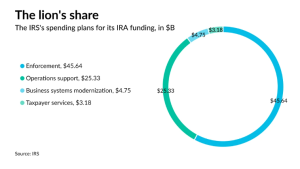

The IRS has specified that the $80 billion will be distributed across three primary areas:

- To “rebuild and strengthen” customer service operations, which experienced significant setbacks during the pandemic, resulting in infamously long wait times on IRS phone lines;

- To augment the agency’s ability to audit high-income taxpayers (roughly 30,000 individuals earning more than $10 million per year) and intricate large businesses; and,

- To modernize the agency’s numerous outdated technology systems.

The strategic plan includes 42 “key initiatives” and 190 “key projects” that the IRS will carry out over the next decade, with the option to introduce additional projects as required.

While the plan refers to the hiring of nearly 30,000 new employees, including 5,000 customer service representatives, it does not specify how many of these new hires will be assigned to enforcement roles. However, given that $45 billion of the total $80 billion is designated for enforcement, it is probable that a considerable number of new employees will be allocated to this area.

A significant portion of the new hires will offset ongoing attrition and the long-term reduction in funding and staffing levels. The IRS currently has around 80,000 employees, approximately 19% fewer than the 95,000 it had in 2010.

Werfel stressed that the agency has been unable to provide the level of service taxpayers deserve for several years. He stated that the IRS is enthusiastic about showcasing how the actions outlined in the plan will lead to concrete improvements for taxpayers, with technology and in-person assistance forming essential elements of this endeavor.

The commissioner asserted that the influence of the additional funding is already evident, as the first signs of change can be observed during this tax filing season. He referred to the substantial improvement in phone service due to increased staffing, the expansion of walk-in services nationwide, and the implementation of new digital tools as initial steps in this transformative process.