Propono Tax Blog

Your Go-To Resource For All Things Tax

When we’re not busy resolving tax problems, we’re tirelessly learning everything we can about tax resolution. From the latest tax news, tips, to how-to’s, we’ve got all the resources you need to support you during your tax troubles.

March 9, 2023

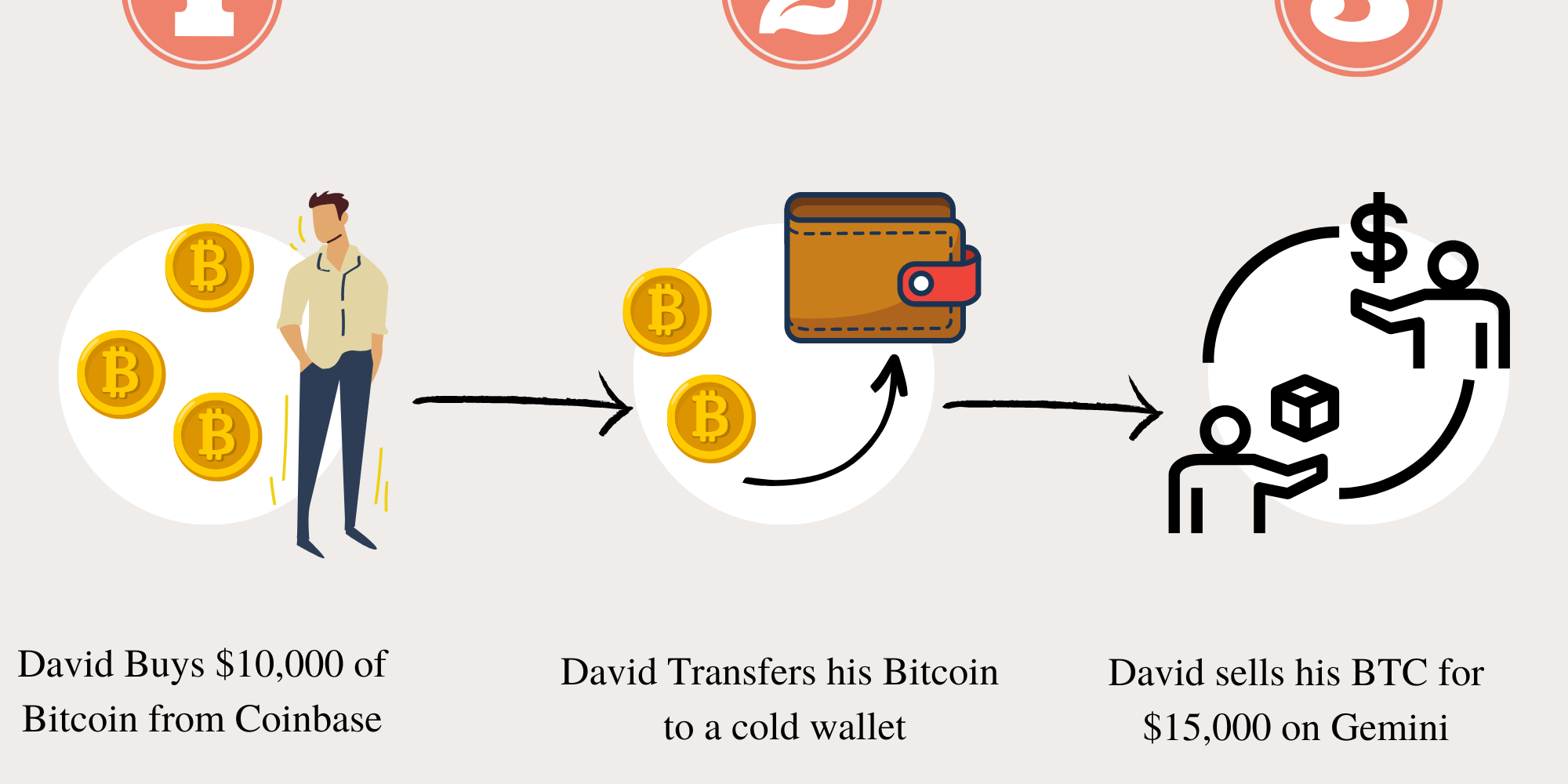

Form 1099-B can make it easy to report your cryptocurrency capital gains — but it may contain inaccurate or incomplete information about your tax liability.

In this guide, we’ll cover everything you need to know about Form 1099-B for cryptocurrency taxes. We’ll explain what you should do if you receive Form 1099-B and discuss why Form 1099-B can lead to tax reporting issues for crypto investors. Do I have to report crypto on my taxes? Cryptocurrency is…

March 1, 2023

How to Prepare for an IRS Audit

Filing taxes can be a daunting process, but for some it's much more than that - an IRS tax audit. This stressful situation involves having the IRS put your tax return under a microscope to see if you reported all your income and to see if you overstated your deductions and expenses. The IRS’s main…

January 15, 2023

How to Avoid an Expensive Tax Bill…What to Do If You Receive One

Tax bill season can be a time of great anticipation for millions of Americans with dreams of a nice, big, refund check coming soon. Yet this year, many Americans may find themselves surprised and coming up short on their refunds. Many taxpayers have been shocked to find that this year, instead of a…

January 3, 2023

What is a Federal Tax Lien Notice & What Should You Do If You Receive One?

Ignoring your obligation to pay taxes can lead the federal government to conduct severe legal action against all of your existing assets, current and future income and assets you acquire in the future; this form of punishment is called a federal tax lien. If you've received a certified letter…

November 30, 2022

Do You Owe Money to the IRS but Can’t Pay? Try This.

When you owe back taxes and can’t afford to make any payments, then it may be time for a special tax status known as currently not collectible. This means that your debt is still considered valid even though there's no chance at recovery right now. When you’re approved for currently not collectible…