IRS Announces Key Updates and Relief Measures

Tax Filing Commences for 2023 Earnings The Internal Revenue Service (IRS) has announced that taxpayers can start filing their taxes on 2023 earnings from January 29, 2024. This marks the official commencement of the 2024 tax season, signaling the need for taxpayers to prepare their documents and filings.

Significant Penalty Relief for Taxpayers In a major development, the IRS is offering penalty relief for eligible taxpayers who were impacted by the pause in collection notices during 2020 and 2021. This relief comes as part of the IRS’s response to the COVID-19 pandemic, during which it temporarily halted the mailing of automated payment reminders for overdue tax bills. While reminder notices were suspended, penalties for failing to pay continued to accrue, placing an added burden on taxpayers.

This new penalty relief is expected to benefit nearly 5 million taxpayers, providing an estimated $1 billion in tax relief. Targeted primarily at individuals earning under $100,000 annually, this relief represents a significant easing of the financial burden for many.

Staggered Account Adjustments The IRS has detailed a phased approach to making these adjustments. Individual accounts have already been adjusted, with business accounts set to follow in late December to early January. Trusts, estates, and tax-exempt organizations will see adjustments in late February to early March 2024.

For those eligible, this relief is automatic, requiring no action on their part. Taxpayers who have already paid the penalties but qualify for relief will receive refunds or have their payments credited against outstanding tax liabilities. However, it’s important to note that the failure-to-pay penalty will resume on April 1, 2024, for eligible taxpayers.

IRS Commissioner Comments on Relief Measures IRS Commissioner Danny Werfel emphasized the agency’s commitment to supporting taxpayers, especially those who haven’t received communication from the IRS in a while and might face a sudden tax bill. This penalty relief is part of the IRS’s broader effort to provide a more taxpayer-friendly approach.

Important Dates and Deadlines for 2024 Tax Season

- Tax Season Start Date: January 29, 2024.

- Federal Tax Return Deadline: April 15, 2024.

- Extended Deadlines for Maine and Massachusetts: April 17, 2024, due to state holidays.

- Special Provisions for Disaster Areas: Additional filing time may be available.

The IRS expects to process over 128.7 million individual tax returns by the April 15 deadline, with most refunds issued within 21 days, and many available by February 27. However, some returns requiring additional review may take longer.

IRS Launches Direct File Program In a transformative move, the IRS is introducing the pilot Direct File program in 2024. This program allows eligible taxpayers to file their 2023 federal tax returns online directly with the IRS, free of charge. Initially available in phases, the program is expected to be fully operational by mid-March.

Eligible residents in 12 states, including those from states without an income tax, can participate if they meet specific criteria. Four states – Arizona, California, Massachusetts, and New York – are collaborating with the IRS to integrate state taxes into the program.

Commissioner Werfel assures taxpayers of continuous improvements in IRS operations, emphasizing the agency’s commitment to utilizing new funding to enhance taxpayer services.

Our sister company, Heritage Tax Company, is accepting new tax clients. Click here for the New Client Application.

5 Common Triggers for Small Business IRS Audits: How to Stay Prepared

IRS audits can be a source of anxiety for both individual taxpayers and small business owners. In recent years, the IRS has increased its focus on auditing small and medium-sized businesses, especially those with relatively low annual revenue. While there's no foolproof way to avoid an audit, being aware of common red flags and taking preventive measures can significantly reduce your risk. In this blog post, we'll explore five reasons why small businesses get audited and provide tips on how to minimize your audit risk.

1. Reasonable Salary Small businesses structured as S-Corporations need to pay their shareholder-employees reasonable salaries. Paying an unreasonably low or high salary can trigger an audit, as it may be an attempt to avoid payroll taxes. Determining what constitutes "reasonable compensation" can be complex, but conducting market research and ensuring your salaries align with industry standards can help you stay in compliance.

2. Losses and Deductions While itemizing deductions is common for small business owners, having an excessive number of deductions can raise red flags. Deductions must meet the criteria of being both "ordinary" and "necessary" for your trade or business. Keep meticulous records, retain receipts, and ensure your deductions align with IRS guidelines to avoid scrutiny.

3. Shareholder Distributions Shareholder distributions must be handled alongside reasonable compensation. Making distributions without providing proper compensation can attract IRS attention as an attempt to avoid payroll taxes. Understand your options, which include no compensation, reasonable compensation, or a combination of both. Be aware that retroactive distributions may come with additional costs.

4. Employment Tax Compliance Misclassifying workers as independent contractors when they should be employees is a common audit trigger. Independent contractors should have control over their schedules, work assignments, and conditions. Review IRS guidelines carefully when hiring new workers to avoid misclassification and potential liabilities.

5. Entity-Level Issues Businesses that deal primarily in cash transactions, such as restaurants or beauty salons, may face a higher risk of audits due to the difficulty of tracking cash income. While cash transactions are essential for some businesses, maintaining impeccable records and accurately reporting income is crucial to minimize audit risk.

While IRS audits remain a concern for small businesses, understanding these common triggers and taking proactive steps to address them can help you reduce your audit risk. Ensuring reasonable compensation, careful deduction reporting, proper handling of shareholder distributions, accurate worker classification, and diligent record-keeping can go a long way in keeping your small business in compliance with tax regulations. Remember, being prepared and informed is your best defense against potential audits.

Your Guide to the IRS's ERC Voluntary Disclosure Program

The IRS has launched a groundbreaking initiative aimed at helping businesses correct and repay questionable Employee Retention Credit (ERC) claims. In this blog post, we delve into the details of the ERC Voluntary Disclosure Program—a unique opportunity for businesses to rectify their claims and avoid penalties. Act swiftly, as the program is open only until March 22, 2024.

Understanding the Background

The IRS initiated this program as part of its ongoing efforts to combat aggressive marketing practices surrounding the ERC. Some businesses were misled into making erroneous claims, and the IRS is keen on setting things right. This voluntary disclosure program is designed to provide relief to eligible businesses while ensuring tax compliance.

Previous Initiatives

Earlier this year, the IRS began mailing letters to thousands of taxpayers, notifying them that their ERC claims had been disallowed. These letters were sent to businesses that did not meet the basic eligibility criteria. To further assist businesses, a withdrawal option was introduced in October, allowing certain employers to withdraw their ERC claims, avoiding future repayment, interest, and penalties. This option has already seen millions in ERC claims being withdrawn.

In September, the IRS implemented a moratorium on processing new ERC claims, set to last until early 2024. No new claims will be reviewed or processed during this period.

Key Details of the Disclosure Program

Interested businesses must apply for the ERC Voluntary Disclosure Program by March 22, 2024. If accepted, they will need to repay only 80% of the credit they received. The IRS will not charge interest or penalties on these repayments. Any interest paid on the ERC refund claim does not need to be repaid.

For businesses unable to repay the credit in full, there may be an option for an installment agreement on a case-by-case basis. However, entering into such an agreement without repaying the required 80% upfront will result in penalties and interest.

The IRS chose the 80% repayment figure to accommodate businesses that were lured into making questionable claims by unscrupulous preparers who often took fees of at least 20%, leaving businesses without the full credit.

Disclosure Requirements

As part of the application process, businesses must provide the IRS with information about advisors or tax preparers who advised or assisted with their ERC claims. This information will be used to identify patterns of abuse and ensure promoters are held accountable.

Eligibility

Businesses that have already received the ERC but aren't entitled to it can apply for the program if they meet certain criteria:

- Not under criminal investigation

- Not under an IRS employment tax examination

- Not received an IRS notice and demand for repayment of the ERC

- The IRS has not received noncompliance information from a third party

How to Apply

To apply, businesses must complete Form 15434, "Application for Employee Retention Credit Voluntary Disclosure Program," available on IRS.gov. The form must be submitted using the IRS Document Upload Tool. Employers who outsource payroll must have the third party file Form 15434.

Next Steps

Once accepted into the program, an IRS employee will review the application and answer any questions. If approved, businesses will receive a closing agreement and will need to repay 80% of the ERC received using the Electronic Federal Tax Payment System (EFTPS). For those unable to pay in full, an installment agreement may be an option, but it comes with penalties and interest.

Ongoing Efforts

The ERC Voluntary Disclosure Program is just one step in the IRS's ongoing efforts to combat ERC fraud. The IRS is intensifying audits and investigations into dubious claims and urging businesses to review ERC requirements and consult with tax professionals to ensure compliance.

Conclusion

The ERC Voluntary Disclosure Program offers a valuable opportunity for businesses to correct their claims, avoid penalties, and promote tax compliance. Take action before March 22, 2024, to benefit from this initiative and protect your financial interests.

Stay tuned for more updates on tax regulations and compliance. www.proponotaxresolution.com

Navigating the Employee Retention Credit (ERC) Minefield

In 2020, as a part of the CARES Act, the U.S. government introduced the Employee Retention Credit (ERC), a vital tax relief measure to counter the economic impact of the COVID-19 pandemic. Aimed at supporting businesses that kept paying their employees during this challenging period, the ERC offered a refundable tax credit on wages paid between March 12, 2020, and January 1, 2022. Businesses were eligible to claim this credit on their quarterly employment tax returns, providing much-needed financial relief during a time of unprecedented hardship.

However, the well-intentioned ERC soon became a target for abuse. Misled often by aggressive marketing tactics, some businesses filed claims without fully meeting the eligibility criteria, leading to a substantial number of improper claims. Recognizing this issue, the IRS implemented a moratorium on processing new ERC claims from September 14, 2023, allowing them time to conduct thorough compliance reviews and protect legitimate businesses from the consequences of fraudulent claims.

The IRS's response didn't stop there. More than 20,000 letters have been sent out to notify taxpayers of disallowed ERC claims, focusing particularly on entities that either didn't exist or lacked paid employees during the eligibility period. This action is part of a larger effort to maintain the integrity of the ERC and includes programs like special withdrawal options for pending claims and a voluntary disclosure program for those who wish to rectify their situation and avoid future IRS action.

Amidst this intensified scrutiny, many taxpayers and business owners find themselves overwhelmed and uncertain. This is where Propono steps in, offering expert tax resolution and representation services. Our team is well-versed in the complexities of the ERC and is ready to assist you, whether you're disputing a claim, seeking guidance on compliance, or facing an audit.

If you've inadvertently filed an inaccurate ERC claim or are unsure about your claim's accuracy, it's crucial to take proactive steps. Propono can assist you in reviewing your situation and, if necessary, in withdrawing your claim before it's processed by the IRS. This proactive step can prevent future repayments, interest, and penalties, offering a vital lifeline for businesses that may have been misled into filing ineligible claims.

For example, ABC Tech, a small software development company, faced significant financial challenges during the COVID-19 pandemic. With a reduction in client contracts and revenue, the company looked for ways to support its workforce. ABC Tech's owner heard about the Employee Retention Credit and believed it could provide the needed relief. In 2021, ABC Tech filed for the ERC, claiming a credit of $50,000. The claim was based on the wages paid to its ten employees during the pandemic. The company included this credit in its quarterly employment tax return, expecting a refund from the IRS.

However, upon review, the IRS denied the ERC claim made by ABC Tech. The IRS investigation found that although ABC Tech did experience a decrease in business, it did not meet the required threshold of a "significant decline in gross receipts" as outlined in the ERC guidelines. Additionally, the IRS discovered that ABC Tech had received a Paycheck Protection Program (PPP) loan and used it to cover the same payroll costs for which they claimed the ERC. Since double-dipping into both relief programs for the same expenses was not permitted, ABC Tech's ERC claim was deemed ineligible.

As a result of the denial, ABC Tech was required to repay the $50,000 credit it had claimed, along with potential penalties and interest. The company also faced additional scrutiny from the IRS for future tax filings.

This example highlights the importance of understanding the specific requirements and guidelines of the ERC program and ensuring that all criteria are met before making a claim. It also underscores the need for accurate record-keeping and possibly seeking advice from a tax professional when navigating these complex tax relief programs.

The landscape of ERC claims has become more challenging than ever, but with Propono's guidance and representation, you can navigate these challenges confidently. We're here to ensure that your business's financial health is safeguarded and that your tax obligations are managed successfully.

For anyone navigating these turbulent waters, remember: the right advice and representation are key to staying compliant and managing your tax obligations effectively. Trust in Propono's expertise to guide you through these complex times. Contact us today for expert assistance with your ERC and other tax-related concerns.

Divorce and Taxes

Divorce is sticky and never fun.

In a complex Virginia divorce case, a stay-at-home mother faced the daunting challenge of understanding her husband's business finances. Without this knowledge, she was at a clear disadvantage. To remedy this, she sought the expertise of Cheryl B. Hyder, a forensic accountant. Hyder's intervention was a game-changer. She not only unearthed vital financial information but also demystified it for the layperson. Her skill in making sense of intricate financial records became a key factor in achieving a fair division of assets in court.

Cheryl B. Hyder's journey into forensic accounting is rooted in her passion for clarifying financial complexities. With a solid background in tax, she shifted her focus to forensic accounting in the 1990s. Hyder's knack for problem-solving goes beyond the financial realm, as evidenced by her volunteer work with a pit bull rescue organization, showcasing her diverse set of interests and commitment to community service.

Forensic accountants like Hyder are increasingly essential in various sectors, not just in personal disputes. With over 62,000 Certified Fraud Examiners worldwide, a number that has grown by 18% since 2018, their expertise is sought after in a range of scenarios. They engage in tasks such as business valuation, tracking assets in offshore accounts, dissecting financial frauds, and even tracing cryptocurrency transactions linked to these frauds. Their skills are indispensable in unraveling the web of complex financial transactions.

High-profile divorce cases often highlight the significance of forensic accountants. In the notable divorce of actor Kevin Costner, forensic accountants played a pivotal role. They meticulously analyzed detailed financial records, from lavish expenditures to concealed assets, providing insights that heavily influenced court decisions regarding child support and legal fees.

The meticulous nature of forensic accounting involves scrutinizing every financial detail, no matter how minor. This thorough approach is vital not only in divorce cases but also in corporate disputes and fraud investigations. By identifying specific spending patterns, forensic accountants can uncover hidden income streams or provide evidence of fraudulent activities.

A striking example of this was seen in a Florida divorce case, where forensic accountants uncovered unauthorized transfers from an inherited estate, demonstrating their critical role in exposing financial malfeasance. Such detailed investigations can transform legal disputes, with the findings often pushing parties towards settlement or arbitration.

The growing complexity of financial transactions in legal disputes, especially in cases involving businesses or international assets, underscores the increasing importance of forensic accountants. Their ability to decode financial intricacies is not merely a mechanism for legal resolution but often serves as a catalyst for reaching equitable settlements. In a world where financial dealings are ever more intricate, the role of forensic accountants in providing clarity and fairness cannot be overstated.

Understanding the Tax Implications of Debt Settlement

During challenging economic times, debt settlement emerges as a strategic option for reducing debt through negotiations with creditors. This approach typically involves discussions with entities such as credit card companies or providers of personal loans to agree on a lower repayment amount. However, navigating this process requires a thorough understanding of several factors that can significantly impact the outcome, including the important aspect of potential tax consequences.

Exploring the Dynamics of Debt Settlement:

The essence of debt settlement lies in the ability to negotiate with creditors to agree on a payment that is less than the total amount owed. This negotiation can occur directly between the debtor and the creditor or can be facilitated through the expertise of specialized debt settlement companies. While this appears as a straightforward method to alleviate financial burdens, it is imperative to comprehend the multifaceted nature of this process and how various elements, such as creditor policies and negotiation tactics, play a crucial role in determining the effectiveness of the settlement.

Navigating Tax Implications with Form 1099-C:

One of the critical aspects of debt settlement is the tax implications associated with the forgiveness of debt. When a creditor agrees to settle for an amount less than the total debt, the forgiven portion is considered as taxable income by the IRS. This is formally documented through Form 1099-C, which is sent to both the debtor and the IRS. For instance, if a creditor forgives $8,000 from a debt, the debtor will receive a 1099-C form for that amount. This results in an increase in taxable income, potentially diminishing the net financial benefit of the debt settlement. Understanding the nuances of this tax obligation and exploring eligibility for any exceptions is a critical step in the process.

Incorporating Taxes and Additional Fees into the Equation:

A comprehensive approach to debt settlement involves factoring in not only the tax implications but also any additional fees that may arise. These fees can include charges by debt settlement companies, often ranging from 15% to 25% of the total debt. For example, in a scenario where a debtor settles a $15,000 debt for $7,000 and subsequently receives a 1099-C for the forgiven $8,000, the additional tax liability could vary significantly depending on the individual’s tax bracket. This added tax burden, along with the fees charged by settlement companies, needs to be considered to accurately assess the overall cost and potential savings of the debt settlement process.

Making an Informed Decision with Professional Guidance:

The complexity of debt settlement, with its varied tax implications and fees, underscores the importance of making informed decisions. Seeking the guidance of financial advisors or legal professionals can provide invaluable insights and advice tailored to individual circumstances. These experts can help navigate the intricate landscape of debt settlement, ensuring that decisions are aligned with long-term financial health and goals.

Utilizing the Insolvency Exception to Mitigate Tax Burden:

The IRS offers a form of relief through the insolvency exception, which can significantly reduce the tax impact of forgiven debt. If a debtor's total liabilities exceed their assets at the time of the debt settlement, they may be able to exclude the forgiven debt from their taxable income, up to the extent of their insolvency. However, leveraging this exception requires careful calculation and proper documentation, making professional advice crucial.

The Bankruptcy Exception: A Pathway to Debt Relief:

In cases where bankruptcy is filed, any debt forgiven as a result of the bankruptcy process is exempt from being treated as taxable income. This legal provision offers a pathway for individuals to achieve substantial relief from both their debts and associated tax liabilities, potentially leading to significant financial savings.

In conclusion, while debt settlement can serve as a valuable tool for individuals grappling with debt, it is vital to have a comprehensive understanding of the associated tax implications, potential exceptions such as insolvency and bankruptcy, and the overall impact of fees. Seeking expert advice before embarking on the debt settlement journey is essential to making informed financial decisions that pave the way for achieving true financial freedom. Please contact us for more information. 207-901-1000.

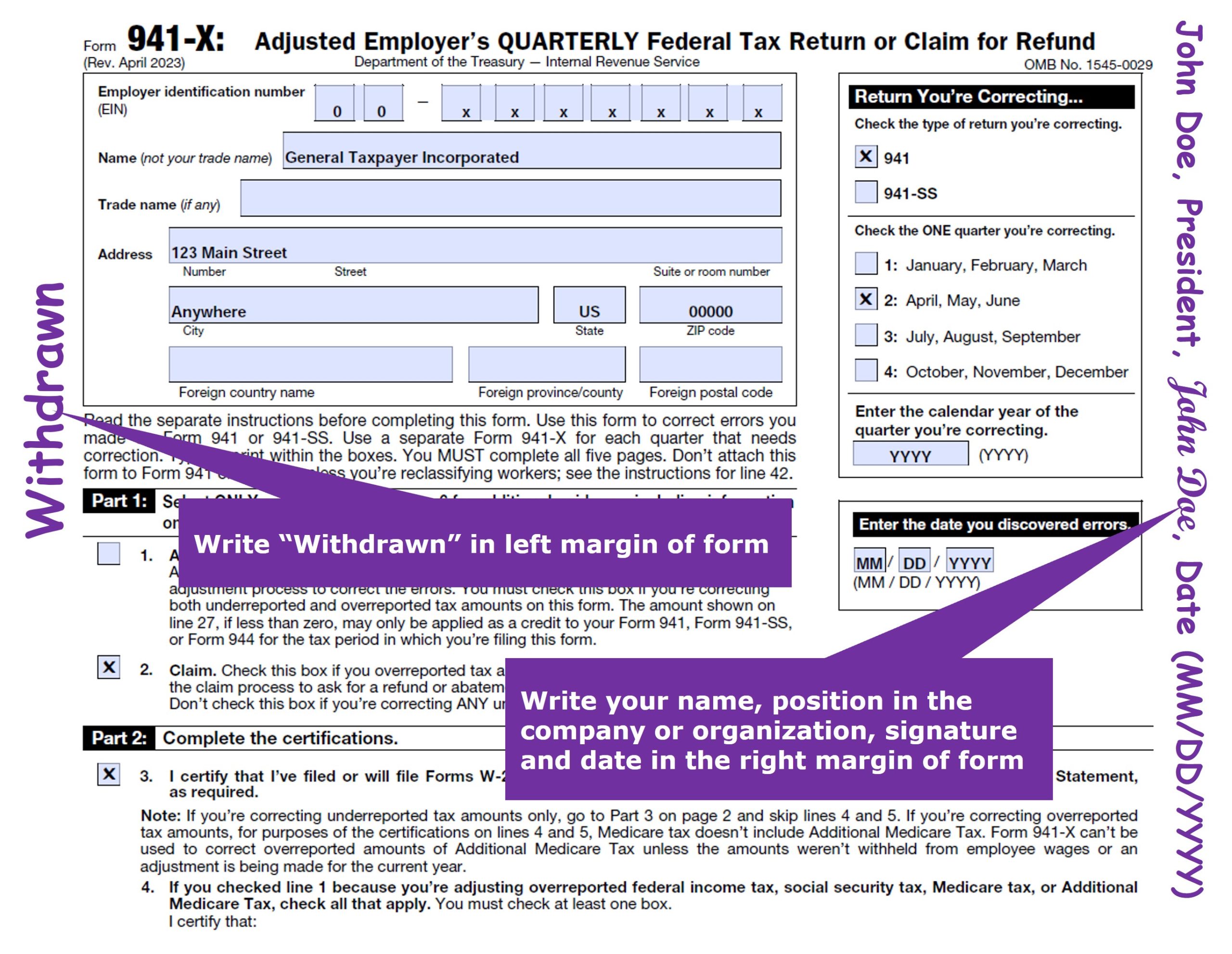

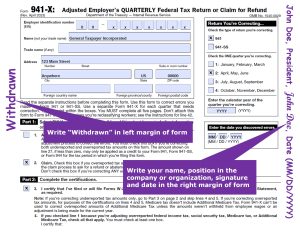

IRS Introduces Relief Option for Employers Affected by ERC Scams

The Internal Revenue Service (IRS) has rolled out a lifeline for employers who have unwittingly fallen victim to scams associated with the Employee Retention Credit (ERC). This move follows the IRS's temporary suspension of new ERC claim processing due to a substantial increase in submissions, spurred by relentless promotion by entities commonly known as "ERC mills."

Here's a more detailed look at this significant development:

A Way Out: Employers who have previously submitted ERC claims but have not yet received refunds can now opt to withdraw their claims. This new withdrawal option is designed to help these employers avoid future repayment obligations, as well as interest and penalties.

Eligibility Criteria for Withdrawal: To qualify for the withdrawal process, employers must meet specific conditions:

- ERC claims should have been submitted through an adjusted employment return (Forms 941-X, 943-X, 944-X, CT-1X).

- The adjusted return must have been filed exclusively for the purpose of claiming the ERC, with no other adjustments.

- Employers must express their intent to withdraw the entire ERC claim.

- Importantly, the IRS should not have already disbursed payment for their claim, or if payment was issued, it should not have been cashed or deposited.

No Penalties or Interest: Employers who choose to withdraw their claims will not face any penalties or interest. The IRS will treat these claims as if they were never filed.

This IRS initiative aims to protect well-meaning businesses that may have been misled by aggressive marketing tactics employed by certain entities promoting the ERC. It underscores the importance of employers exercising caution, staying well-informed about the ERC, and avoiding costly loans or falling prey to scams.

For detailed instructions on how to withdraw an ERC claim and additional pertinent information, please visit IRS.gov/withdrawmyERC.

The IRS remains steadfast in its commitment to supporting small businesses and organizations as they navigate the complexities associated with the Employee Retention Credit. If you have questions or require further assistance, please do not hesitate to reach out.

Stay informed, stay vigilant, and stay protected.

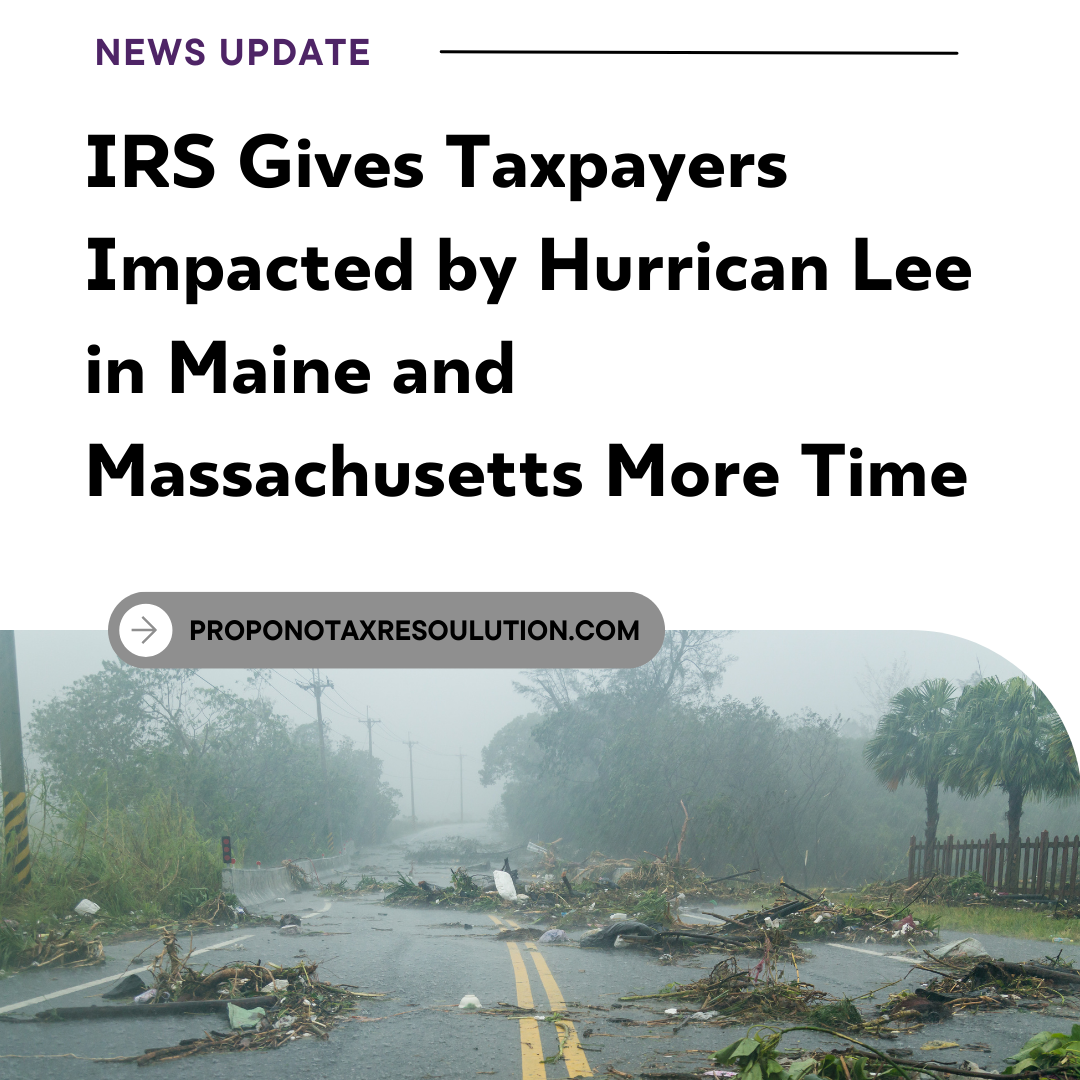

IRS Grants Extension to Taxpayers Affected by Hurricane Lee in Maine and Massachusetts

Hurricane Lee, a significant event during the 2023 Atlantic hurricane season, left its mark on the northeastern United States earlier this year. In response, the IRS has introduced tax relief measures for both individuals and businesses impacted by the storm in Maine and Massachusetts. These taxpayers now have until February 15, 2024 to file their 2022 tax returns.

Eligible Recipients

The IRS extends its relief to all areas officially designated as disaster zones by the Federal Emergency Management Agency (FEMA). As a result, individuals and businesses located in the following Maine counties can take advantage of this tax relief: Androscoggin, Aroostook, Cumberland, Franklin, Hancock, Kennebec, Knox, Lincoln, Oxford, Penobscot, Piscataquis, Sagadahoc, Somerset, Waldo, Washington, and York.

Navigating the Rising Tide of ERC Audits: Safeguarding Your Business with Expert Guidance

The IRS has announced its plan to audit a large number of Employee Retention Credit (ERC) claims that officials believe may be fraudulent, and many business owners have already been targeted for ERC audits. Officials have warned multiple times about third-party tax credit specialists improperly filing ERC credits on behalf of unknowing clients, and many of these claims could lead to potential penalties for business owners. Amid a landscape of increasing IRS scrutiny, Enrolled Agents can help protect their clients by recommending they review their ERC filings ahead of the IRS to help avoid tax penalties that could be levied in an ERC audit.

The Employee Retention Credit (ERC) is a refundable tax incentive intended to help small and medium-sized businesses survive the pandemic. Passed in early 2020 as part of the CARES Act, the ERC was initially designed to help companies continue paying employees during the COVID-19 pandemic.

Multiple IRS Warnings of ERC Fraud

In late 2022, IRS officials began issuing warnings to small businesses regarding the Employee Retention Credit, stating that some third-party ERC processing companies, or “ERC mills,” have fraudulently claimed or overclaimed tax credits for their clients.

Businesses qualify for the credit by meeting specific criteria including undergoing full or partial suspension of operations due to government mandates or a significant decline in gross profits during the years 2020 or 2021.

In many cases, questionable “ERC mills” have misled honest business owners by advising them to apply for ERC credits even if they do not meet the standards set out by the IRS. In other cases, these popup providers didn’t do their due diligence to document their clients’ qualifications or may have overclaimed their refund amounts. While putting these small businesses at greater ERC audit risk, these third-party providers often charge hefty upfront fees or take a large percentage of an anticipated refund amount, decreasing the company’s overall benefit and setting them up for tax issues down the road.

The IRS has renewed its ERC scam warning repeatedly over the first half of 2023, even placing these tax cheat tactics atop the new Dirty Dozen list.

Many Enrolled Agents and other tax advisors are concerned their clients may have used one of these third-party processors that turned out to be an ERC mill and are actively looking for resources to identify risks associated with their clients’ ERC filings. Fortunately, there are professionals offering guidance for reviewing ERC compliance before the IRS launches an audit.

Will ERC Claims be Audited?

The IRS is auditing ERC claims more frequently in response to the prevalence of abuse, scams, and fraud. Officials deem ERC compliance a high enforcement priority, increasing the number of Employee Retention Credit audits they will undertake and violations they will pursue.

Businesses that claimed ERC using a third party who did not provide them with a detailed study to document the calculation methodology or substantiate the ERC claim could be at risk of penalties if they are selected for an ERC audit.

IRS Begins Issuing IDRs

Regarding ERC Claims In addition to the Employee Retention Credit fraud outlined above, many companies are finding that their ERC provider did not provide the proper documentation to back up their claim. This spells trouble for businesses that do not have substantiation of their ERC’s validity. The IRS will send an Information Document Request (IDR) to employers targeted for Employee Retention Credit audits.

What Documentation Is Needed in an ERC Audit?

When a company receives an IDR regarding its ERC, the list of requested documentation is extensive. Accounting professionals can work with their clients to ensure they have the necessary documentation on hand.

When a business is targeted for an ERC audit, it may be asked to produce the following records with only 10 business days to reply:

- Employee and owner records

- Payroll data

- Gross receipts for 2019-2021

- Previously filed tax forms

- The names of all parties with interest (ownership) in the business

- A detailed calculation of the ERC credit for each employee

- Notices of operational suspension during the eligibility period

- Copies of relevant Covid Orders used to justify a full or partial suspension of operations

- Paycheck Protection Program (PPP) application and loan forgiveness documentation.

If a business owner cannot produce these records upon receiving an IDR, they may quickly land in hot water with IRS auditors.

How Long Can the IRS Audit ERC?

The IRS recently extended the statute of limitations on ERC refunds by two years, giving itself a total of five years to conduct audits on businesses that may lack proper documentation proving their eligibility. Those businesses that have or will be applying for the ERC before it ends in 2024 (for 2020) and 2025 (for 2021) must file amended tax returns (941x) for any taxes already submitted. There is also no time limit for the IRS to audit what they believe to be false or fraudulent ERC claims intentionally filed to evade employer payroll taxes.

This extension to the ERC audit period indicates the IRS has a special interest in auditing Employee Retention Credit claims and highlights the need for business owners to review the validity of their claims.

What the IRS Examines in ERC Audits

When auditing ERC claims, the IRS will look at three primary areas: eligibility, confirmation of the claimed refund amount, and whether an amended tax return was filed. For eligibility, they will want to see copies of government orders that required a partial or complete shutdown of business, including:

Health restrictions

Documented evidence that key suppliers were shut down due to a government order, meeting the IRS’ definition of supply chain suspension Closure schedules Documentation proving a 10% nominal disruption to business operations For the claim amount, they will need to see how calculations were arrived at, the impact of the pandemic on company revenue, and proof of employee eligibility. Finally, IRS auditors will look at all the supporting documentation relating to the ERC filing.

What It Could Cost

If your small business is audited and the amount of the ERC credit is reduced, the ERC audit penalty may range from 20% for inaccuracies to 75% if the IRS believes it was intentional fraud. In the most egregious cases, the IRS could pursue criminal fraud charges that include both ERC penalties and imprisonment.

Being Ready for a Potential ERC Audit

The best way for accountants and advisors to help their clients prepare for a potential ERC Audit is to have a professional doublecheck their claims for ERC compliance. By reviewing the needed documentation, a professional can help clarify the situation for business owners, ensuring that your clients do indeed meet eligibility requirements, that the credit amounts were properly calculated, and that they possess all necessary documentation to substantiate their claims.

Review Your ERC Filing with Propono’s Experts

Propono provides a comprehensive analysis of existing ERC claims, reviewing filings for adherence to all qualifications and IRS rules, and identifying any potential liabilities or errors. Once the analysis is completed, Propono provides a thorough report outlining any inaccuracies, areas of concern, or red flags in the work of the initial ERC processor. This allows small businesses to correct errors or further substantiate their claims ahead of a potential audit, thus avoiding tax penalties.

The ERC Filing Review is a proactive step that companies can take to find inaccuracies or mistakes before the IRS does. Propono’s team helps each business review its existing documentation and determine if additional information is needed to back up its filing. They will also confirm the ERC claim and determine if a new amended return is needed, pre-empting any such discovery by the IRS.

Now is the time for small businesses to reexamine their ERC claims and ensure the work done by their ERC processor. CPAs, business advisors, and tax professionals who believe their clients may have claimed ERC under questionable circumstances should recommend they review their filings with the ERC specialists at Propono.

Clarifying Misconceptions about Tax Relief: A Guide for Small Businesses and the Employee Retention Credit

The wake of the pandemic saw many businesses mistakenly claim tax relief benefits, largely due to misinformation, according to National Taxpayer Advocate, Erin Collins. This specifically pertains to the Employee Retention Credit (ERC), a measure introduced to help small businesses during the COVID-19 crisis.

The ERC provides up to $5,000 per employee for 2020 or $28,000 per employee for 2021, and there's still time to amend returns and claim this credit. However, the complexity of the relief scheme has led to an influx of firms falsely asserting businesses' eligibility.

"Unfortunately, individuals have been misguided," stated Erin Collins at the recent annual conference of the American Institute of Certified Public Accountants. This has led to some businesses erroneously claiming and even receiving refunds.

The IRS has been vocal in cautioning against 'third parties' promoting the ERC and even featured the issue in its 2023 Dirty Dozen list of tax scams. Recent data reveals that over 866,000 companies have successfully claimed ERCs, totaling over $152.6 billion.

However, the IRS now faces a backlog of Form 941-Xs, which businesses must submit to amend returns and claim the ERC. As of mid-June, about 537,000 forms remained unprocessed.

Collins asserts that the IRS is formulating guidance for those who might have inaccurately claimed the credit. She urged businesses that realize they are ineligible to act promptly and rectify the situation.

Rosemary Sereti, managing director of Deloitte Tax and former IRS senior executive, also emphasized the importance of businesses taking the initiative to correct ERC-related mistakes.

Of the backlog, Collins noted that many are "legitimate claims" awaiting IRS examination. The IRS has allocated trained staff at two locations to process the backlog and examine potential Covid-19 credits.

Businesses that have inaccurately claimed the ERC may face penalties, warns Debra Estrem, managing director of private wealth controversy at Deloitte Tax, and former IRS Office of the Chief Counsel employee. The specific penalty depends on whether the error was on the original or amended return and can generally amount to 20% of the excessively claimed amount.