IRS Introduces Relief Option for Employers Affected by ERC Scams

The Internal Revenue Service (IRS) has rolled out a lifeline for employers who have unwittingly fallen victim to scams associated with the Employee Retention Credit (ERC). This move follows the IRS's temporary suspension of new ERC claim processing due to a substantial increase in submissions, spurred by relentless promotion by entities commonly known as "ERC mills."

Here's a more detailed look at this significant development:

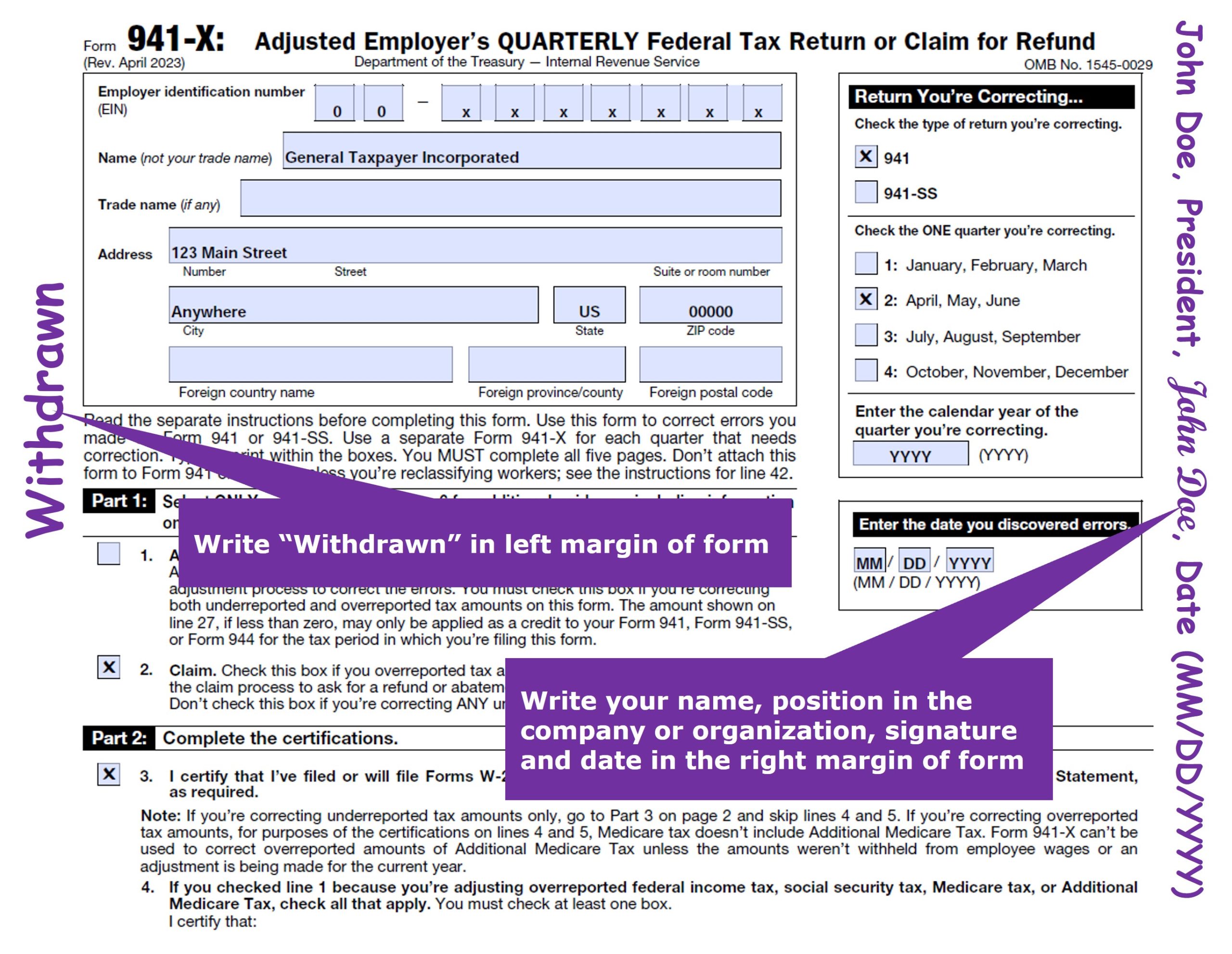

A Way Out: Employers who have previously submitted ERC claims but have not yet received refunds can now opt to withdraw their claims. This new withdrawal option is designed to help these employers avoid future repayment obligations, as well as interest and penalties.

Eligibility Criteria for Withdrawal: To qualify for the withdrawal process, employers must meet specific conditions:

- ERC claims should have been submitted through an adjusted employment return (Forms 941-X, 943-X, 944-X, CT-1X).

- The adjusted return must have been filed exclusively for the purpose of claiming the ERC, with no other adjustments.

- Employers must express their intent to withdraw the entire ERC claim.

- Importantly, the IRS should not have already disbursed payment for their claim, or if payment was issued, it should not have been cashed or deposited.

No Penalties or Interest: Employers who choose to withdraw their claims will not face any penalties or interest. The IRS will treat these claims as if they were never filed.

This IRS initiative aims to protect well-meaning businesses that may have been misled by aggressive marketing tactics employed by certain entities promoting the ERC. It underscores the importance of employers exercising caution, staying well-informed about the ERC, and avoiding costly loans or falling prey to scams.

For detailed instructions on how to withdraw an ERC claim and additional pertinent information, please visit IRS.gov/withdrawmyERC.

The IRS remains steadfast in its commitment to supporting small businesses and organizations as they navigate the complexities associated with the Employee Retention Credit. If you have questions or require further assistance, please do not hesitate to reach out.

Stay informed, stay vigilant, and stay protected.

IRS Grants Extension to Taxpayers Affected by Hurricane Lee in Maine and Massachusetts

Hurricane Lee, a significant event during the 2023 Atlantic hurricane season, left its mark on the northeastern United States earlier this year. In response, the IRS has introduced tax relief measures for both individuals and businesses impacted by the storm in Maine and Massachusetts. These taxpayers now have until February 15, 2024 to file their 2022 tax returns.

Eligible Recipients

The IRS extends its relief to all areas officially designated as disaster zones by the Federal Emergency Management Agency (FEMA). As a result, individuals and businesses located in the following Maine counties can take advantage of this tax relief: Androscoggin, Aroostook, Cumberland, Franklin, Hancock, Kennebec, Knox, Lincoln, Oxford, Penobscot, Piscataquis, Sagadahoc, Somerset, Waldo, Washington, and York.