Top 10 Tips to Avoid Tax Auditing: Keep your finances in order with these expert suggestions

No one wants to face a tax audit, but the truth is that many taxpayers may unknowingly take actions that can raise red flags with the Internal Revenue Service (IRS). While there's no surefire way to completely avoid an audit, there are steps you can take to minimize the likelihood of drawing unwanted attention to your tax return. Here are our top 10 tips to help you avoid tax auditing and keep your finances in order.

Tax Tips: Be Accurate and Thorough

Accuracy is crucial when it comes to filing your taxes. Double-check your calculations, make sure you're using the correct tax forms, and ensure that you've provided complete and accurate information. This includes reporting all your income, as underreporting can trigger an audit. Don't forget to include even small amounts from side jobs, as the IRS will likely have a record of those earnings.

Report All 1099 and W-2 Income

The IRS receives copies of all your W-2 and 1099 forms, so it's essential to report all income received, including wages, interest, dividends, and freelance income. Double-check the amounts on your forms against what you report on your tax return to avoid discrepancies.

Avoid Filing Paper Returns

Filing your taxes electronically can significantly reduce the risk of making errors, as the software automatically checks for issues and prompts you to fix them. According to the IRS, the error rate for paper returns is around 21%, while the rate for electronically filed returns is only 0.5%.

Keep Organized Records

Maintaining well-organized and accurate records is essential to avoid discrepancies in your tax return. If you're audited, having clear documentation will make it easier to prove your deductions and credits. Keep receipts, invoices, and other financial records for at least three years, as this is the typical period the IRS can audit.

Be Cautious with Deductions

Claiming unusually high deductions can catch the attention of the IRS, especially if they're disproportionate to your income. While you should claim all legitimate deductions, be careful not to inflate your expenses. Always have documentation to back up your claims in case of an audit.

Be Mindful of Business Expenses

The IRS scrutinizes self-employed individuals and small business owners more closely than regular wage earners, as they have more opportunities to manipulate their income and expenses. Ensure you separate your personal and business expenses, and only claim deductions that are directly related to your business operations.

File on Time

Filing your tax return late or requesting multiple extensions can raise suspicion. To avoid drawing attention to your return, file on time and pay any taxes owed by the deadline.

Check Your Math

Simple mathematical errors are one of the most common reasons for the IRS to question a tax return. Double-check your calculations and consider using tax software to minimize the chance of errors.

Report Foreign Assets

If you have foreign bank accounts or assets, make sure to report them as required by law. Failing to disclose foreign financial assets can result in severe penalties and increase your likelihood of an audit.

Seek Professional Help

If you have a complicated tax situation, it's wise to consult with a tax professional who can help you navigate the process and ensure your return is accurate and compliant. They can also offer guidance on tax-saving strategies and help you avoid potential red flags.

While there's no foolproof way to avoid a tax audit, following these expert tax tips can help you minimize the risk and keep your finances in order. Remember, the key is to be accurate, thorough, and honest in your tax reporting. If you do find yourself facing an audit, you can contact Propono at (207) 901-1000 for a free consultation.

Form 1099-B can make it easy to report your cryptocurrency capital gains — but it may contain inaccurate or incomplete information about your tax liability.

In this guide, we’ll cover everything you need to know about Form 1099-B for cryptocurrency taxes. We’ll explain what you should do if you receive Form 1099-B and discuss why Form 1099-B can lead to tax reporting issues for crypto investors.

Do I have to report crypto on my taxes?

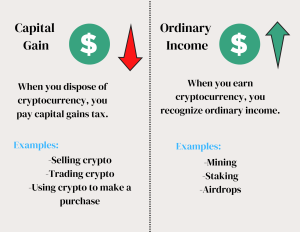

Cryptocurrency is considered property by the IRS and is subject to capital gains and ordinary income tax.

What is Form 1099-B?

Form 1099-B is a tax form designed to track the disposals of capital assets. The form contains details about cost basis, gross proceeds, and capital gains and losses.

Like other 1099 forms, Form 1099-B is issued to taxpayers and to the IRS.

Stockbrokers like Robinhood and eTrade typically send out 1099-Bs for your stock trading activity at the end of the year. At this time, cryptocurrency exchanges are not required to send 1099-Bs to customers.

Do you get a 1099-B for cryptocurrency?

As of 2021, there hasn’t been explicit guidance around what 1099s cryptocurrency exchanges should provide to customers and the IRS. As a result, different exchanges take different approaches to tax reporting.

While some exchanges issue 1099-B to customers, most currently do not send tax forms detailing capital gains and losses to customers.

This will change in the near future. The Build Back Better Act included requirements for cryptocurrency brokers to report capital gains and losses to customers and the IRS.

It’s not yet clear when mandatory 1099 reporting will go into effect. The IRS announced in December 2022 that these requirements would be delayed indefinitely.

It’s not yet clear when mandatory 1099 reporting will go into effect. The IRS announced in December 2022 that these requirements would be delayed indefinitely.

What tax forms should I receive from cryptocurrency exchanges?

Cryptocurrency exchanges may send you other versions of Form 1099 — such as Form 1099-MISC and Form 1099-K.

Does Coinbase issue Form 1099-B?

Like other major exchanges, Coinbase currently does not issue Form 1099-B to customers and the IRS. For more information, check out our guide: Does Coinbase Report to the IRS?

Which exchanges issue 1099-B?

Here are some popular exchanges that issued Form 1099-B to customers for the 2021 tax year.

Bittrex

BlockFi

Cash App

Robinhood

Uphold

Do I need to include 1099-B on my tax return?

There’s no need to attach Form 1099-B on your tax return, but you can use the information on the form to keep track of your capital gains and losses.

What happens if I don’t report 1099-B income to the IRS?

If you don’t report taxable income that’s been reported to the IRS on Form 1099-B, it’s likely that your tax return will be flagged automatically and you will be sent a warning letter about your unpaid tax liability.

Remember, all of your cryptocurrency disposals and income are required to be reported whether they are on Form 1099 or not. The IRS can often track your cryptocurrency transactions even if they are not mentioned on these tax forms.

How do I report cryptocurrency disposals?

All cryptocurrency disposals (including those reported on a 1099-B) should be reported on Form 8949, along with a description of the property, your cost basis and gross proceeds, and the date you acquired and disposed of your assets.

For more information, check out our guide to reporting your cryptocurrency taxes.

What happens if I didn’t get a 1099-B from my exchange?

You are required to report all your taxable transactions to the IRS regardless of whether your exchange sends relevant tax forms. Failure to do so is considered tax fraud.

Which crypto exchanges do not report to the IRS?

At this time, centralized exchanges like KuCoin and decentralized exchanges like Uniswap do not issue Form 1099-B or other tax forms to the IRS.

Still, it’s important to remember that not reporting your cryptocurrency income on your tax return can lead to fines, audits, and even potential jail time.

For more information, check out our guide to non-KYC exchanges.

Why does my Form 1099-B have incomplete/inaccurate information?

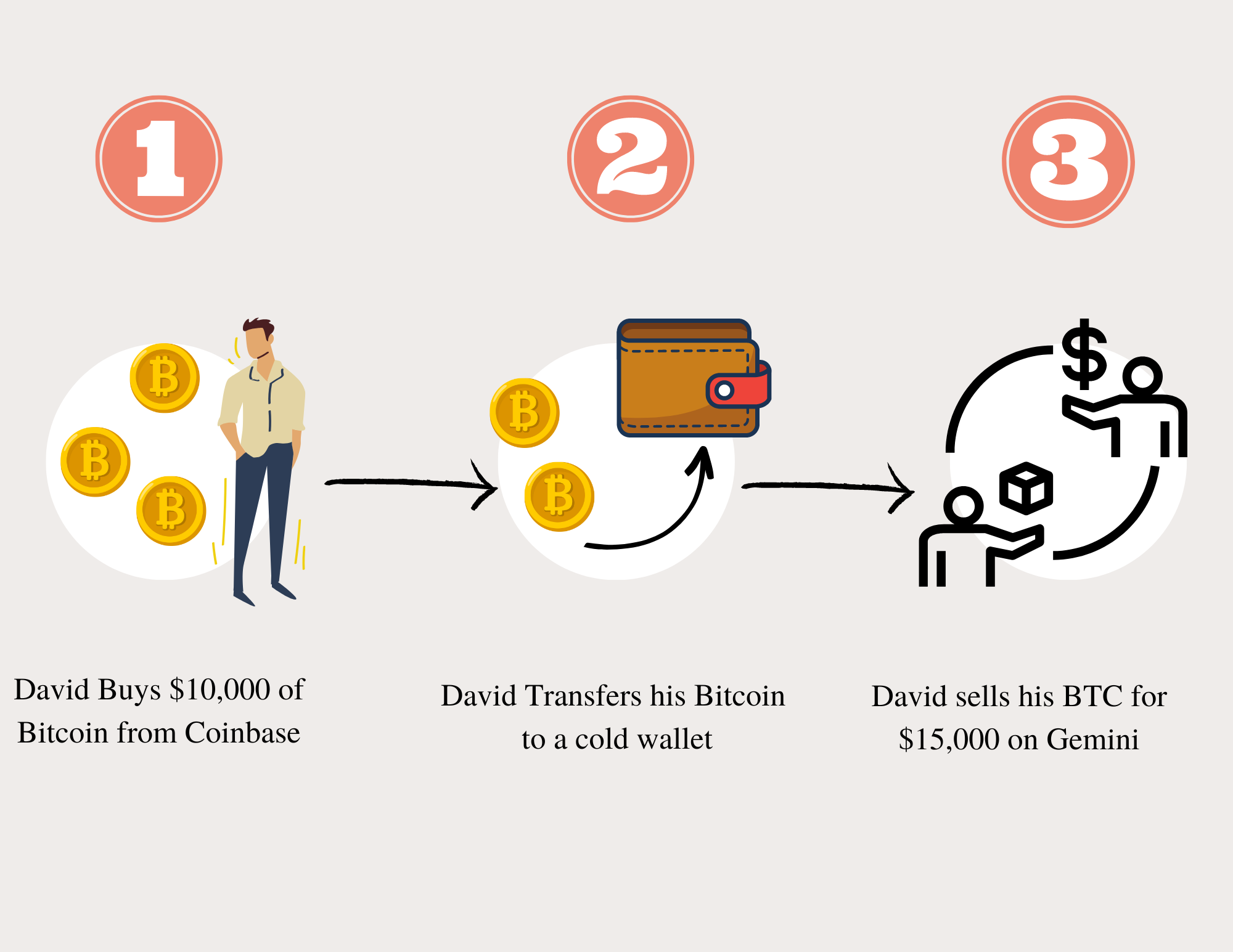

Transfers between different exchanges and wallets can lead to inaccuracies on Form 1099-B. In these situations, your cryptocurrency exchange might not have data on cost basis that’s needed to calculate your capital gains and losses.

For example, consider the following scenario.

This guide covers everything you need to know about Form 1099-B for cryptocurrency taxes, including why it can lead to tax reporting issues for crypto investors. Although Form 1099-B can simplify reporting your cryptocurrency capital gains, it may contain incomplete or inaccurate information about your tax liability.

If you're wondering whether you need to report cryptocurrency on your taxes, the answer is yes. The IRS considers cryptocurrency property and subject to capital gains and ordinary income tax.

Form 1099-B is a tax form specifically designed to track the disposals of capital assets, including cryptocurrency. The form contains important information such as cost basis, gross proceeds, and capital gains and losses. Like other 1099 forms, it's issued to both taxpayers and the IRS.

While stockbrokers like Robinhood and eTrade typically send out 1099-Bs for your stock trading activity at the end of the year, cryptocurrency exchanges are not currently required to send 1099-Bs to customers. However, some exchanges may send other versions of Form 1099, such as Form 1099-MISC or Form 1099-K.

It's important to note that failure to report taxable income, whether it's been reported on a 1099-B or not, can lead to fines, audits, and even potential jail time. Even if your exchange doesn't issue a 1099-B, you're still required to report all your taxable transactions to the IRS.

If you do receive a 1099-B from your exchange, you don't need to attach it to your tax return, but you can use the information on the form to keep track of your capital gains and losses. You should report all cryptocurrency disposals, including those reported on a 1099-B, on Form 8949, along with a description of the property, your cost basis and gross proceeds, and the date you acquired and disposed of your assets.

It's worth noting that different exchanges take different approaches to tax reporting, and as of 2021, there hasn't been explicit guidance around what 1099s cryptocurrency exchanges should provide to customers and the IRS. While some exchanges issue 1099-Bs to customers, most currently do not send tax forms detailing capital gains and losses to customers. However, the Build Back Better Act included requirements for cryptocurrency brokers to report capital gains and losses to customers and the IRS, although it's not yet clear when mandatory 1099 reporting will go into effect.

How to Prepare for an IRS Audit

Filing taxes can be a daunting process, but for some it's much more than that - an IRS tax audit. This stressful situation involves having the IRS put your tax return under a microscope to see if you reported all your income and to see if you overstated your deductions and expenses. The IRS’s main goal in an audit is to assess more tax, penalties and interest. It’s an intimidating experience that most Americans dread facing!

An IRS audit can cause even the most squeaky-clean of taxpayers to become fearful and anxious when faced with defending yourself to an auditor. It's understandable why the majority feel powerless in this situation. You also have to understand, and get comfortable with, in the eyes of an IRS auditor, you are guilty until proven innocent. Navigating the tax code on your own is not a good place to be.

Tax audits don't have to be a source of fear as long as you've remained compliant with all the rules and regulations. The best way to ensure peace of mind is to work with an experienced Tax Resolution Specialist who represents clients in such matters and has a good track record. Contact our firm for a complimentary no obligation consultation to assess your situation. HeritageTaxCompany.com

An IRS audit can be a very time consuming and intrusive exercise that can include a visit from the auditor. Audits can also be conducted remotely. This method, known as a desk audit, involves sending documents through fax or mail to evaluate accuracy and compliance with established law.

Filing taxes is a complex process and the IRS seeks to ensure accuracy by auditing income tax returns. These examinations may be focused on certain deductions, particularly if taxpayers have claimed for more than what their reported incomes suggest - but this does not necessarily indicate any wrong-doing or misconduct. The IRS can also select your return to be audited for no reason at all. These are referrer to as “random” audits to ensure compliance with the tax laws.

Taxes are a fundamental pillar of our society and the government strives to ensure that everyone is compliant. To this end, random audits from both Federal and State authorities may be conducted in order to verify taxpayers' income as well as expenses incurred throughout the year; making sure all taxation payments due remain accurate.

Preparing for an IRS tax audit should be an ongoing process. To avoid any problems, ensure that all deductions taken are backed up with proof and every receipt is kept on file along with the return - you never know what may arise in the future! It's important to remember: only declare items which can easily be defended - your documents are a crucial piece to your defense. Ensure each tax record remains safely stored away for at least seven years as per IRS regulations.

Protect your finances and future by taking the time to review your tax returns before signing off, even if you have a professional do them. A thorough examination of the documents will not only help ensure accuracy in filing but also offers an invaluable opportunity for you to gain knowledge on taxes - safeguarding against potential penalties or interest charges related to inaccuracies down the line.

Tax audits can be intimidating, but with a little foresight and the right representation it doesn't have to cause stress. Staying organized throughout the year is key for having peace of mind when tax season rolls around. Finding an experienced professional who understands your individual needs will help make dealing with the audit as painless as possible.

Take the worry out of representing yourself in front of the IRS, which is like going to court without a lawyer. Let our expert team lift this from your shoulders and navigate the IRS on your behalf. Schedule a no-obligation consultation to explore your options and get on track towards permanently resolving any worries you have over having to meet with and defend yourself in an IRS or State income tax audit.